If you’re a YouTube creator who is not new to crypto, there’s a strong chance you’re already using stablecoins. In fact, over 90% of MilX users who opt for crypto payments rely on USDT or USDC. Why? Because stablecoins solve real financial pain points of creators—payment delays, currency conversion headaches, and high fees.

And the world is catching on. Stablecoins have long outgrown their niche in fintech—they’re now a major force. PayPal introduced its own stablecoin, PYUSD. Stripe just spent over $1 billion acquiring Bridge, a cross-border stablecoin payment orchestration platform.

Meanwhile, stablecoin transaction volumes continue to climb, with Tether at the forefront of this growth. As the largest stablecoin issuer, Tether has surpassed a $120 billion market cap. According to CEO Paolo Ardoino, USDT now holds more U.S. Treasury bonds than Germany, Australia, and the UAE, ranking as the 18th largest holder worldwide.

For creators who rely on fast, flexible, and reliable payments, understanding stablecoins is essential. Let’s break down what they are, why they matter, and how their role in finance affects creators.

What is Stablecoin, Exactly?

Stablecoins are digital currencies pegged to a stable asset, like the US dollar. The most common types are fiat-collateralized stablecoins like USDT (Tether) and USDC (USD Coin), which are backed 1:1 by actual cash or cash-equivalent reserves. Other variations include commodity-backed stablecoins (e.g., gold-backed stablecoins), crypto-collateralized stablecoins, and algorithmic stablecoins.

They take the speed, efficiency, and borderless nature of crypto but remove the extreme volatility that makes traditional cryptocurrencies unreliable for day-to-day transactions. Think of them as digital dollars that offer a modern payment method without the headaches of banks.

However, not all stablecoins are created equal. USDC, issued by Circle, is known for its transparency and regular audits, while USDT remains the most widely used stablecoin. But not every project has stood the test of time—TerraUSD (UST) collapsed due to flawed algorithms, and Iron Finance’s TITAN suffered a dramatic crash, wiping out investor funds. For creators relying on stablecoins, understanding an issuer’s credibility and the strength of its reserves isn’t just important—it’s essential.

The Key Benefits of Stablecoins for YouTube Creators

Simon Taylor compares the current state of stablecoins to dial-up internet in the 1990s—something with undeniable potential, but not fully built out yet. They’re not replacing banks or credit cards overnight, but for YouTube creators, they’re already solving real financial headaches.

Fast payouts, lower fees, and global accessibility make them an obvious choice, even as regulations and infrastructure catch up. The real question isn’t whether stablecoins will take over—it’s how they’ll fit into the broader financial system. Right now, they give creators a level of speed and control that traditional payments can’t match. So, let’s break down why they’re becoming the go-to option.

1. Lower Fees—More Money in Your Pocket

Traditional platforms take their cut: PayPal (2% capped at $20), wire transfers ($40 flat fee), Payoneer (1% minimum $3), Skrill (up to 4.99% for international transfers), and banks often adding hidden FX markups.

Why is that so? These platforms don’t just move money—they handle regulatory compliance, dispute resolution, and customer support, all of which add costs. The fees fund these services, ensuring transactions are secure and reversible when necessary.

Crypto transfers, on the other hand, don’t carry these overhead costs. Since blockchain transactions are final and irreversible, there’s no need for dispute resolution, chargeback protection, or intermediary banks. This efficiency allows stablecoins and other cryptocurrency assets to move across borders with minimal fees.

That said, not all stablecoin transactions are cheap. Blockchain transfers can vary based on the blockchain network you use—ERC20 fees typically range from $10-15 per transfer, while cheaper alternatives like TRC20 and BEP20 can be as low as $1. On congested blockchains like Ethereum, transaction fees (gas fees) can spike. Additionally, some centralized exchanges charge withdrawal fees when converting stablecoins back into fiat currency.

Despite these considerations, stablecoins remain one of the most cost-effective payment methods for YouTubers dealing with international transactions.

MilX helps you save on crypto transfers by offering multiple networks like ERC20, TRC20, and BEP20—so you choose the lowest fees. Download MilX on Android or iOS and transfer your YouTube earnings in cryptocurrency.

2. Privacy & Anonymity

Crypto transactions offer a level of financial independence that traditional banking systems can’t match. While every crypto transaction is recorded on a public blockchain, users are identified by wallet addresses rather than personal details. This means your financial movements aren’t tied to a bank account or centralized financial institution.

For creators, this provides added flexibility. Payments can be received and sent without the need for intermediaries, reducing bureaucratic delays and potential account freezes. Additionally, peer-to-peer transactions allow direct payments without revealing sensitive financial information. The transparency of blockchain ensures security while keeping unnecessary oversight to a minimum.

This raises a key question: does financial freedom come at the cost of regulation? Some argue that stablecoins make it easier for illicit transactions to go undetected. While blockchain records every transaction, anonymous wallet addresses create compliance challenges.

To prevent misuse, reputable stablecoin issuers enforce KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. They work with regulators, conduct audits, and use blockchain analytics to spot suspicious activity.

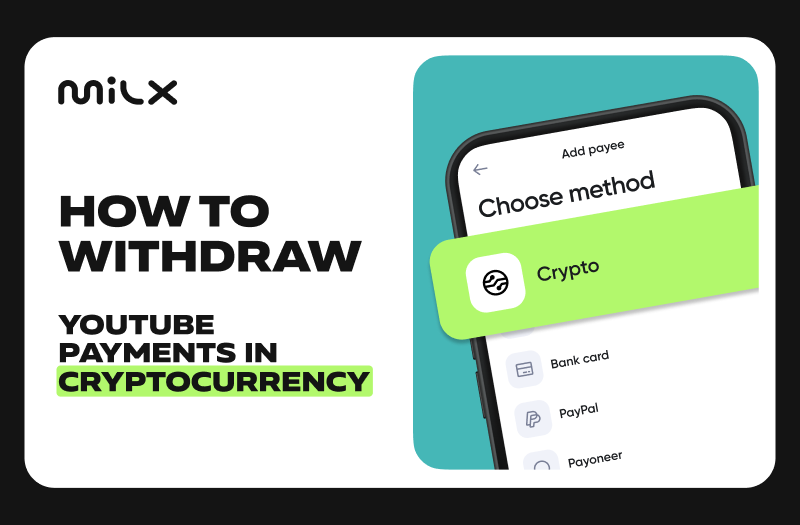

Most methods to transfer YouTube earnings to cryptocurrency require cashing out through platforms like PayPal, Payoneer, or bank transfers, adding delays, fees, and tracking. With MilX, your earnings go straight to your crypto wallets, privately. Download MilX and cash out in crypto.

3. Faster and More Efficient Global Transactions

For creators working with international teams, crypto payments offer a faster, cheaper, and more accessible alternative to traditional banking. Stablecoins enable instant, 24/7 transactions without the delays of banks, SWIFT transfers, or intermediaries.

Traditional cross-border payment systems rely on a patchwork of correspondent banks that introduce inefficiencies. A payment from a creator in the U.S. to an editor in the Philippines, for example, can pass through multiple banks, each taking a cut. With stablecoins, the same payment settles in minutes at a fraction of the cost.

This is why major payment methods like PayPal, Visa, and Stripe have started exploring stablecoins—because they recognize that crypto bypasses the legacy system while maintaining the stability of traditional currencies.

For creators, the benefits are clear:

- Instant payments—no waiting for banking hours, holidays, or settlement delays.

- No middlemen—payments go directly to the recipient without passing through multiple banks.

- Lower currency conversion costs—stablecoins eliminate hidden FX fees and markup rates.

And this trend is only accelerating. For YouTubers managing a global business, stablecoins offer a smarter way to move money—fast, cost-effective, and without the limitations of traditional banking.

4. Investing & Growing Your Wealth

Earning in stablecoins opens up strong investment opportunities, often with higher returns than traditional banks. Unlike bank savings that offer minimal interest, stablecoins can be used in decentralized finance (DeFi) platforms to generate passive income in several ways.

Staking in Liquidity Pools

Creators can deposit stablecoins into liquidity pools on specialized platforms. These pools provide the liquidity needed for crypto trading, and in return, participants earn a share of the transaction fees. The more trading activity on the platform, the more passive income creators generate. Rewards are typically paid in the platform’s native token, which can be reinvested or converted into stablecoins.

Earning Through Lending

Lending platforms allow creators to lend their stablecoins to borrowers, earning interest in return. These platforms work similarly to traditional banks but with higher yields and no middlemen. Creators simply deposit their stablecoins, and the platform automatically matches them with borrowers. Interest is paid over time, often in real-time, providing steady passive income.

Investing in Other Cryptocurrencies

For long-term growth, creators can convert stablecoins into cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or Solana (SOL). Exchanges like Binance, Coinbase, and Kraken make it easy to swap stablecoins for other assets. This approach allows you to invest in digital assets while keeping the flexibility to move funds quickly. A common strategy is dollar-cost averaging (DCA)—investing small amounts regularly to reduce risk from price fluctuations.

Higher Returns Than Banks

Many DeFi platforms offer annual percentage yields (APY) that far exceed traditional savings accounts. For example, staking USDC on a reputable platform might yield 5-10% APY, compared to less than 1% in a traditional bank. These opportunities make stablecoins an attractive choice for creators aiming to grow their earnings.

For creators planning ahead, stablecoins are a powerful tool to earn, invest, and grow their income—all while avoiding the limitations of traditional banking.

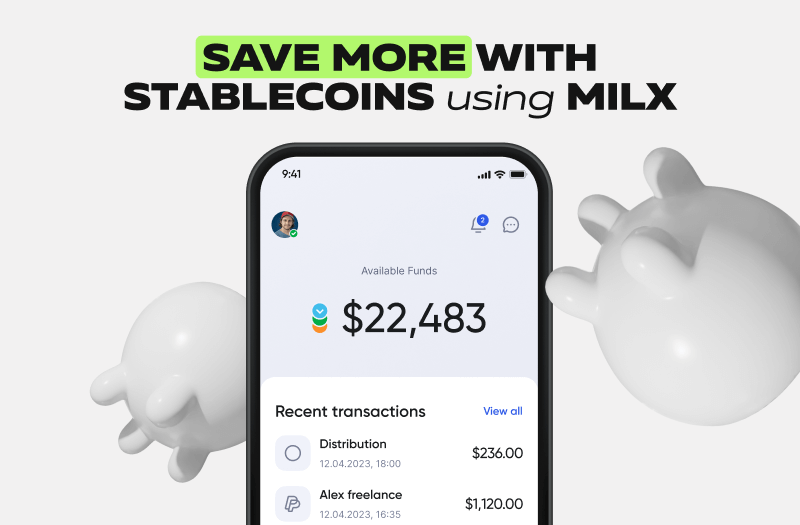

Take Full Advantage of Stablecoins with MilX for YouTube Creators

The MilX app lets YouTubers take full advantage of stablecoins like USDT and USDC—without the usual headaches of bank restrictions, high fees, or delays. With low-cost payouts, instant transfers, and multiple blockchain options, MilX ensures you can cash out earnings faster, cheaper, and avoid intermediaries.

With MilX, you get:

- Multiple blockchain options – Receive USDT and USDC on ERC20, TRC20, BEP20, and Polygon (for USDT) or ERC20 and BEP20 (for USDC), so you can always pick the lowest-fee network.

- Low fees on stablecoin transfers – Withdraw USDT or USDC with just a 2.5% fee plus blockchain network costs—far cheaper than traditional payment platforms.

- Fast payouts – Standard withdrawals take 0-5 business days, while Instant Payments by MilX delivers funds within 5 minutes.

- Low minimums – Cash out stablecoins starting at just $15, making it accessible for all creators.

- High transaction limits – Move up to $20,000 per instant payment and $100,000 daily, so you're never restricted by banking caps.

With the MilX app, you control how and when you get paid—without banks slowing you down. The app is completely free, and you’ll always see payment fees upfront, so you know exactly what you’re paying. No hidden costs. No surprises. Just your money, your way.

The Bigger Picture: Stablecoins in the Creator Economy

The trends are clear. Big fintech players are moving into stablecoins. Transaction volumes are exploding. YouTube creators—especially those operating internationally—are realizing how much they’ve been overpaying in fees and delays.

There’s still a long road ahead. Stablecoins aren’t perfect, and regulators are scrambling to define their role. Some believe they’ll eventually be absorbed into central bank digital currencies (CBDCs), while others see them as the future of independent financial systems.

For YouTubers who care about getting paid faster, keeping more of their earnings, and having full financial control, stablecoins aren’t just a "nice to have"—they’re a necessity. Download the MilX app today and start receiving your YouTube payments in stablecoins.