Most YouTube creators lose money without realizing it—missed deductions, unexpected tax bills, or getting hit with hidden currency conversion fees.

At MilX, we’ve identified the most common financial mistakes creators make and outlined simple ways to fix them. Use this guide to take control of your finances and make your YouTube income work harder for you.

Taxes: Plan Ahead to Keep More of Your YouTube Earnings

Every dollar you earn from AdSense, sponsorships, merchandise, or memberships is gross income. YouTube doesn’t deduct taxes, so you’re responsible for staying compliant. If you don’t plan ahead, tax bills and penalties can sneak up on you, creating unnecessary financial stress.

Track All Your YouTube Income

In the U.S., if you earn more than $600 from AdSense or a sponsorship, you’ll receive a 1099 form. But not all income is automatically reported—small payments can add up quickly. Keep track of everything, including brand deals, memberships, and merchandise.

If you expect to owe more than $1,000 in taxes, make estimated quarterly payments. This avoids penalties and reduces your year-end bill.

Leverage Tax Deductions

You can claim deductions for content-related expenses to reduce your taxable income. This keeps more of your YouTube revenue in your pocket. To do this, keep accurate records and separate personal and business finances with a dedicated business bank account.

Common deductions include:

- Equipment and software: Cameras, lighting, editing tools.

- Travel costs: Flights, hotels, meals for business trips.

- Home office expenses: A portion of rent, utilities, and internet.

- Education: Courses or coaching to level up your skills.

- Subscriptions: Adobe Premiere, Canva, or music licensing services.

Staying organized and tracking these expenses can significantly reduce your taxable revenue and maximize your YouTube income.

Consult with a Specialist

There are ways to stay compliant and reduce taxes on your YouTube income, but the best strategies depend on your location, earnings, and unique circumstances. You can also work with an accountant or financial advisor to help you plan, claim deductions, and manage your taxes effectively, ensuring you keep more of what you earn.

The Reluctant Investor Syndrome: Prioritize Yourself

Many creators hesitate to spend on growth, fearing the cost. But failing to reinvest is one of the biggest mistakes you can make. Your channel’s success depends on its quality and output, and smart investments pay off.

Use Financial Tools to Invest in Growth

The MilX app allows you to access up to six months of YouTube revenue upfront. Use this to upgrade your equipment, improve production quality, or hire help like editors or managers. Don’t let cash flow limit your channel’s growth.

Treat Your Channel Like a Business

Set aside 20–30% of your YouTube income to reinvest. This could mean hiring editors, subscribing to premium tools, or experimenting with new content formats. Better quality videos lead to better engagement, more views, and higher YouTube revenue.

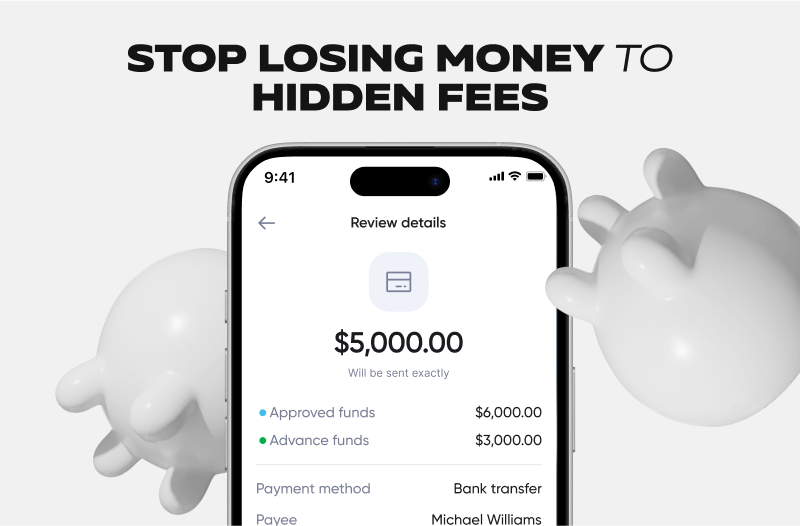

Currency Conversions: Reduce Silent Profit Eaters

Earning internationally often comes with hidden costs. Many creators unknowingly lose thousands annually due to poor currency exchange practices that eat into their YouTube income.

Optimize Currency Conversion Tools

Standard banking systems often impose hidden fees on currency conversions. Switching to platforms like MilX, which supports over 40 currencies, helps you retain more of your YouTube channel income. Transparent conversion rates mean no surprises, ensuring you keep what you earn.

Tailor your payment methods to your operational needs. For example, if you’re earning in USD but paying expenses in EUR, choose platforms that allow you to withdraw directly in the currency you need. This eliminates the costly double conversions that can eat into your YouTube revenue.

Consider Cryptocurrency for Lower Fees

Cryptocurrency offers you a cost-effective alternative for minimizing transaction fees. All crypto transfers generally come with lower fees compared to traditional banking methods. With MilX, you can transfer YouTube payments directly to crypto wallets, including BTC transfers at 0% fees.

Additionally, MilX provides a variety of networks to choose from, allowing you to select the most cost-efficient option and further reduce fees. For creators handling frequent international transactions, this means significant savings and greater control over your earnings.

Download MilX for Android or iOS. Get fast access to your YouTube revenue, extra cash when you need it, and flexible options to transfer money globally. MilX helps you lower expenses on financial operations, so you can keep more of what you earn and focus on growing your channel.

Collaborator Payments: Efficiency Matters

If you’re managing freelancers, editors, or team members, transaction fees and disorganized payments can drain your resources. Improving efficiency here can make a noticeable difference in your YouTube income.

Use Free Peer-to-Peer Payment Platforms

MilX allows you to send free P2P payments to collaborators. This eliminates transaction fees for routine payments, leaving more of your YouTube channel income intact.

Provide Teams with Tools to Streamline Transfers

Invite your team or collaborators to join MilX for P2P payments and send funds to them instantly and without fees. This simplifies routine payments for editors, designers, or freelancers and eliminates the need for complex bank transfers, saving time and money.

Schedule Payments to Save Time

Setting up regular payments with platforms like MilX eliminates the hassle of managing individual transactions. MilX allows you to automate recurring payments to your team on a set schedule. This not only saves time but also ensures consistency and reliability, freeing you up to focus on scaling your YouTube channel instead of handling payment logistics.

Contingency Planning: Expect the Unexpected

Algorithm changes, policy shifts, or unexpected expenses can disrupt your income from YouTube. Having a contingency plan ensures resilience and keeps your YouTube revenue steady, even when unexpected events arise.

Diversify Revenue Streams

Relying solely on AdSense is risky. For example, many creators experience seasonal income drops when CPM rates plummet. To stabilize your YouTube revenue, explore multiple income streams such as memberships, merchandise, or paid partnerships.

A gaming creator could offer exclusive tutorials through memberships, while a fitness creator might sell branded workout plans or custom water bottles. These additional revenue sources provide consistent YouTube income even during periods of fluctuating ad rates.

Build Emergency Funds

Unexpected costs can strike at any time—your main camera could break before a major shoot, or policy changes might reduce your earnings from a specific content type. By saving six months’ worth of operational expenses, you create a safety net to protect your YouTube channel income.

For example, if your monthly expenses for editing, gear, and travel are $3,000, save at least $18,000. This fund ensures that you can cover emergencies like demonetization or sudden equipment repairs without compromising your channel's performance.

Leverage Fast Access Funds

When immediate cash flow is needed, use MilX to access advance payments. For instance, imagine receiving an opportunity to collaborate with a major sponsor that requires upfront investment in production quality, such as new lighting or cameras. Instead of waiting weeks for your next YouTube payments, MilX allows you to unlock up to six months of revenue instantly, enabling you to seize opportunities without financial stress.

A Mindset Shift

Financial success on YouTube isn’t just about earning more—it’s about managing what you already have. We’ve seen creators with massive channels struggle because they ignored small but crucial details like reinvesting in their content, organizing payments, or planning for unexpected hits to their income.

Don’t wait for things to go wrong. Get proactive, streamline your finances with MilX, and protect your YouTube revenue.